Lehman Brothers CEO Fuld Blames Everyone But Himself, Is Being Investigated By Three U.S. Attorney's Offices, And Gets Punched In The Face Over The Weekend By A Former Lehman Bros Employee.

"Look, Sally, look. Look down. Look down Sally. Look down, down, down. See Sally. See Sally See. See Dick's $10.8 million Greenwich home!"

"What is Lehman's strength also became Lehman's weakness," one former executive at the bank has stated. "The plus was that there was continuity. The negative side was that, as the game changed, the senior people became too removed."

Richard "Dick" Fuld, the CEO who led Lehman Brothers into bankruptcy after the Feds decided not to try to save it, was defensive when questioned by the House Oversight Committee yesterday.

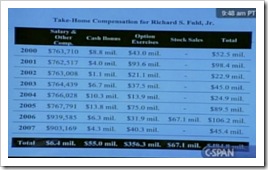

Chair Henry Waxman (D-CA) asked Fuld "You've been able to pocket close to half a billion dollars [since 2000] and my question to you is that fair for a CEO of a company that's now bankrupt? It's just unimaginable to so many people." Fuld's reply was "I think for the years you're talking about here I believe my cash compensation was close to 60 million and the amount I took out of the company over and above that was closer to 250 million."

The NY Times reports he "blamed the news media. He blamed the short-sellers. He blamed the government, as well as what he characterized as an extraordinary run on the bank", but he "never really blamed himself.

Fuld did take responsibility for the collapse stating, "I want to be very clear. I take full responsibility for the decisions that I made and for the actions that I took based on the information that we had at the time."

From an email (PDF) obtained for the Oversite Committee, Fuld had felt confident in April 2008, after leaving a dinner with Hank Paulson, the Treasury secretary. In an email to his chief legal officer, Thomas Russo, , Fuld said that Paulson, the former chief executive of Goldman Sachs, had a "worried view" about Merrill Lynch but that Lehman had a "huge brand" with the US Treasury.

Fuld had stated in the testimony given that would wonder "until they put me in the ground" why the US government had not rescued the 158-year-old firm but yet saved AIG. He said that regulators were fully aware of its plight before its collapse.

FOR SALE

June 2008

It was evidently clear that Lehman was showing the first signs of trouble in June, 2008. In an email (PDF) from a representative of Centaurus Capital, it stated that many bankers had been calling him in the last days. That he was worried that "all the hard work we have put in over the last 6/7 years could unravel very quickly." He suggested that two things needed to happen quickly. First was some "senior managers have to be much less arrogant and intentionally admit that some major mistakes had been made." And secondly, "Some changes at senior management level need to happen very soon." He finished with "We also need to hire a few very senior guys VERY quickly to bolster confidence."

August, 2008

In August, 2008, Lehman's held talks to sell up to 50 percent of its shares to the government-owned Korea Development Bank in South Korean or China's Citic Securities in the first week of August, but failed to reach an agreement with either. The South Koreans and Chinese walked away after concluding that Lehman was asking too high a price. Lehman declined to comment at the time. Lehman's shares had fallen nearly 85 percent since early 2007. Lehman's at the time was also considering selling all or part of its holdings, including its troubled $40 billion commercial real estate portfolio and its asset management arm, which included Neuberger Berman.

The South Koreans discussed a two-step process under which Korea Development Bank would buy a 25 percent stake directly from Lehman and another 25 percent of the shares though a market tender. The price under discussion was 50 percent above Lehman's book value. The two sides were said to have been close to a deal but last-minute disagreements ended the talks.

Simultaneously, Lehman met top executives of Citic Securities but these talks never reached the level of those with the South Koreans.

September, 2008

Going into the weekend of September 13-14, just before the bankruptcy filing, Fuld testified he was confident he would be able to sell Lehman to another financial institution. "When we walked into that weekend, I firmly believed we were going to do a transaction," he said.

"I think Lehman and Merrill Lynch were in the same position Friday night, and they did a transaction with Bank of America. We went down the road with Barclays but that transaction never got consummated."

Lehman's commercial real-estate portfolio came under review by a number of firms, including Goldman Sachs Group Inc., Credit Suisse Group, Barclays PLC and Bank of America Corp., all of which declined to buy the portfolio. Some executives who looked at the portfolio say they believe the portfolio was being overvalued by Lehman by as much as 35%, as reported in a page-one article in The Wall Street Journal on Monday.

RESPONSIBILITY, ACCOUNTABILTY, AND FAULT

Congressman Waxman asked Fuld, "I have heard you talk about what you should have done differently, but you don't seem to acknowledge that you did anything wrong." Fuld did not reply.

Waxman had to say on Fuld success in his career at Lehman Bros, "It seems that the system worked for you, but it didn't seem to work for the rest of the country and the taxpayers who now have to pay up to $700 billion to bail out our economy. We can't continue to have a system where Wall Street executives privatize all the gains and socialize all the losses."

THROWING MONEY AROUND

Waxman said that in January, 2008, Fuld and his board were warned the company's "liquidity can disappear quite fast." Despite that warning, he said, "Mr. Fuld depleted Lehman's capital reserves by over $10 billion through year-end bonuses, stock buy-backs and dividend payments."

BONUSES GIVEN FOUR DAYS BEFORE FILING BANKRUPTCY

Waxman cited a memo (PDF), among 24 pages of internal emails from Lehman Bros., showing Lehman recommending four days before the bankruptcy filing that three departing executives received more than $20 million in "special payments." On September 11, Lehman planned to approve "special payments" worth $18.2 million for two executives who were terminated involuntarily, and another $5 million for one who was leaving on his own.

"In other words, even as Mr. Fuld was pleading with (US Treasury) Secretary Paulson for a federal rescue, Lehman continued to squander millions on executive compensation," Waxman stated.

Andrew J. Morton was the head of fixed income who was involuntarily terminated. According to the document, his last day worked was "Week of September 8" with a termination date of "December 1, 2008 (after 12 week notice period, per UK policy)". His "Special Payment" was $2 million, plus one year's base salary of $200,000 as standard severance. Fuld stated this was deemed "appropriate for his years of service." The document states that Morton received $14 million in 2006 compensation, and $12.5 million in 2007 compensation. Morton had worked for Lehman for 15 years.

Benoit Savoret, the chief operating officer for Europe and the Middle east was also involuntarily terminated. According to the document, his last day worked was "Week of September 8" with a terminate date of "December 1, 2008 (after 12 week notice period, per UK policy". His "Special Payment" was $16.2 million. The document states that Savoret received $12 million in 2006 compensation, and $18 million in 2007 compensation. Savoret had worked for Lehman for 11 years.

Jeremy Isaacs, who voluntarily terminated was going to be working through year end until December 2008. His terminate date was listed as March 2009 under the same UK policy. Isaacs "Special Payment" was $5 million "described as a minimum amount in his agreement letter. There was an additional term that stated "Any additional amount may be paid, as determined by year end 2008 at the discretion of the Firm and as approved by the Compensation Committee." His 2006 compensation was $21 million, and 2007 was $22.0 million. Isaacs had worked for Lehman for 12 years.

Within the document, there was a compensation arrangement for Gerald Donini, the Global Head of Equities, to "facilitate his retention with the Firm". He was guaranteed a minimum of $20 million in total compensation for 2008 and 2009.

There was also a compensation arrangement for Eric Felder, the recently appointed Global Co-Head of Fixed Income, that he would receive a 2008 cash advance on his 2009 compensation, in the amount of $8.5 million, leaving him to receive $16.4 million (minimum) in 2009.

Rep. Elijah Cummings (D-MD) said, "I don't know how he sleeps at night."

FULD & PRESIDENT BUSH'S COUSIN SCOFF AT IDEA TO FORGO BONUSES IN JUNE 2008

Waxman also released emails (PDF) from June 2008 in which Fuld dismissed the suggestion from 2 lower-level executives, Judy Vale and Bob D'Alelio, co-managers of the $15 billion Small Cap Value product (NB Genesis Fund) at a Lehman subsidiary, Neuberger Berman, that the company's top people forego bonuses because "when the 'world' discovers this at next year's proxy, it would send a strong message to both employees and investors that management is not shirking accountability for recent performance."

On Lehman's executive committee is George H. Walker, President Bush's cousin who shot down the idea, according to the emails. He responded back to all of the executives who had received the original email. "Sorry team. I am not sure what's in the water at 605 Third Avenue today, but Amato and I clearly have some work to do (given the today's similar emails from Marvin Schwartz, Michael Kaminsky and now Judy.) " "The compensation issue she raises (Judy Vale and Benjamin Segal on one hand versus Marvin Schwartz and Jeff Bolton on the other) is a particular issue for a small handful of people at Neuberger and hardly worth the EC's time now." "I'm embarrassed and I apologize."

Fuld then wrote to Shelby Lauckhardt on the matter: "Don't worry - they are only people who think about their own pockets."

OUTBID ON LOBBYING

Rep. John Mica (R-FL) stated that he had pulled Lehman Brothers contributions to Federal candidates for the past 10 years. Mica pointed out that Lehman Brothers gave about $300,000 to influence members of Congress.

The biggest recipient has been the Democratic Senatorial Campaign Committee at $47,000, including $10,000 last year. Lehman Bros gave another $10,000 tot he Republican Senatorial Campaign Committee. The most recent federal donations, $5,000 in May, went to a political action committee funded by Wall Street firms -- some of which no longer exist -- that gave to an array of politicians.

Fuld personally also gave directly to politicians. In March of 2007, $2,300 went to John McCain and in May of 2007, $2,300 went to Barack Obama. New York Senator Charles Schumer has taken $6,000 from Fuld. Joseph Lieberman has taken $7,000. Another $9,600 went to Dodd, including $4,600 last year when the Senate banking committee chair was running for President. Fuld gave $4,600 to Clinton for her presidential run as well.

Since neither Clinton nor Dodd made it past the primary, they were obligated to refund the $2,300 checks he gave to them for the general election campaigns that never came to pass. Dodd sent back the $2,300 on August 21. Clinton gave her's back a week later.

But during the same time, Fannie Mae and Freddie Mac gave $175 million dollars in lobbying contracts over the same 10 years. Mica asked Fuld what he thought of that, and Fuld's reply, with a smirk on his face was "I think that's more of a matter for your committee sir."

AFTER THE TESTAMONY WAS OVER

Waxman concluded the session with a bit of lecture to Fuld. "I accept the fact that you're still haunted at night about the collapse of Lehman," Waxman said. But, he added, "I don't accept the fact that you assert the system worked when you lost your stock."

As the hearing came to a close, Fuld slipped into back offices meant for legislators rather than walk past protestors who had gathered at the hearing. When Fuld emerged, the protestors followed him out of the building, shouting: "Criminal!" As he stepped into a waiting black SUV, Fuld stopped, turned and started at one woman. He then got into the car and was driven away.

THE ENTIRE HEARING CAN BE VIEWED ON THE OVERSIGHT COMMITTEE'S WEBSITE.

UNDER INVESTIGATION BY MULTIPLE U.S. ATTORNEY OFFICES

At least three U.S. attorney offices are probing whether Lehman Brothers Holdings Inc misled investors before its bankruptcy filing.

U.S. Attorney's Office, New York's Southern District

The U.S. attorney's office for New York's Southern District, in Manhattan, is investigating whether Lehman valued its assets at artificially high levels. That office has issued subpoenas to individuals that focus on what the firm told investors and other parties about is valuations for approximately $32.6 billion in commercial-real-estate holdings.

Lehman's commercial real-estate portfolio came under review by a number of firms, including Goldman Sachs Group Inc., Credit Suisse Group, Barclays PLC and Bank of America Corp., all of which declined to buy the portfolio. Some executives who looked at the portfolio say they believe the portfolio was being overvalued by Lehman by as much as 35%, as reported in a page-one article in The Wall Street Journal on Monday.

The Manhattan prosecutors are also interested in whether Lehman improperly moved $8 billion from its London operations to New York just ahead of its bankruptcy filing, a move that has drawn criticism from creditors and accountants.

U.S. Attorney's Office, New Jersey

The U.S. attorney's office in New Jersey is investigating whether Lehman misled New Jersey's pension fund when it provided information about its financial health in connection with a $6 billion stock offering in June. New Jersey invested $180 million in the offering. Its loss on the investment totals about $116 million.

U.S. Attorney's Office, New York's Eastern District

The U.S. attorney's office in New York's Eastern District, in Brooklyn, are probing whether Lehman executives misled by misrepresenting the firm's condition by making upbeat comments during conference calls with analysts and investors.

PUNCH OUT

As for getting punched in the face, it seems that Fuld was "attacked" on a Sunday shortly after it was announced that Lehman Brothers was bankrupt. Following rumors that the incident had occurred, Vicki Ward, a US journalist said "two very senior sources - one incredibly senior source" had confirmed it to her. "He went to the gym after... Lehman was announced as going under," she told CNBC. "He was on a treadmill with a heart monitor on. Someone was in the corner, pumping iron and he walked over and he knocked him out cold. And frankly after having watched this, I'd have done the same too."

Lehman Brothers however, has denied the story going around that Fuld was punched. They claim, in typical denial fashion, that the story is both "completely absurd and completely untrue." Furthermore, according to Charlie Gasparino, who did the original CNBC report, they insist Fuld wasn't punched or even looked at the wrong way at any point in the weeks surrounding Lehman's collapse.

QUICK STATS ON RICHARD S FULD JR

QUICK STATS ON RICHARD S FULD JR

Richard Severin Fuld Jr is 62 years old (04/26/1946) and has been CEO of Lehman Brothers Holdings (LEH) for 15 years. Fuld has been with the company for 39 years. His education is a BS from University of Colorado at Boulder in 1969, and a MBA from New York University's Stern School of Business in 1973.

While attending the University of Colorado, Fuld participated in the Naval Reserve Officer Training Corps program and was president of the school's chapter of the Alpha Tau Omega social fraternity. His career as an Air Force pilot came to an abrupt end when he got into a fist fight with a commanding officer.

After graduating with a bachelor's degree in international business, Fuld then began his career with Lehman Brothers in 1969 beginning as a commercial paper trader.

- August 1984 - August 1990: Vice Chairman of Shearson Lehman Brothers

- August 1990 - March 1993: President and Co-Chief Executive Officer of the Lehman Brothers Division of Shearson Lehman Brothers Inc.

- 1990 to September, 2008: Director of Lehman Brothers Holdings and The Federal Reserve Bank of New York.

- January 1993 - March 1993: Co-President and Co-Chief Operating Officer of Lehman Brothers Holdings Inc and Lehman Brothers Inc.

- March 1993 - April 1994: President and Chief Operating Officer of Lehman Brothers Holdings Inc and Lehman Brothers Inc.

- April 1994 - September 2008: Chairman of the Board of Directors of Lehman Brothers Holdings Inc.

- November 1993 - September 2008: Chief Executive Officer of Lehman Brothers Holdings Inc and also its subsidiary Lehman Brothers

2007 Compensation (Total): $71.90 million

- Salary: $750,000

- Bonus: $4,250,000

- Other: $26,620,000

- Stock Gains: $40,280,000

5-Year Compensation (Total): $354.03 million

Additional offices:

- Chairman & Chief Executive Officer, Lehman Commercial Paper, Inc., a subsidiary of Lehman Brothers Inc. Operates as a commercial money market dealer and it offers financial services. The company buys & sells commercial paper & other money market instruments for its clients. Based in Jersey City, New Jersey. It's estimated annual sales had been around $76 million. The company started in 1990, and filed Chapter 11 bankruptcy on October 5, 2008 listing an estate with assets of $100,000,001+ and liabilities of $100,000,001+. In the filing, Lehman Commercial Paper, Inc filed a "First Day Motion" seeking authority to (i) continue to utilize its agency bank account (ii) terminate its agency relationship, and (iii) continue to "evaluate" participants under its loan participation. The First Day Motion is available by clicking here.

- Director, NYC2012, Inc., a non-profit organization created to promote New York in the competition for the 2012 Olympics bid.

- Chairman, US Thailand Business Council, Focuses on building long-term relationships between U.S. companies and key members of the Thai public and private sectors.

- Trustee, Mount Sinai Medical Center of Florida, A private not-for-profit teaching hospital.

- Director, Ronald McDonald House Charities, Inc., A charitable institution that offers programs focusing on the health and well being of children.

- Director, The Partnership for New York City, Inc., A non-profit organization focusing on research, policy formulation, and issue advocacy at the city, state and federal levels. It formulates policies by economic impact studies. The company also invests in economic development projects.

- Director, The Federal Bank of New York., The Bank supervises and regulates financial institutions to maintain payment systems in New York.

- Director, Robin Hood Foundation., Provides grants, strategic support services, and management assistance to community based programs fighting poverty. It also offers employment programs, lower income victims' services and relief, mental health services, and other grants.

- Trustee, Middlebury College

- Former Trustee, The Mount Sinai Hospital

On March 30, 2008 Fuld owned 1.96 percent of Lehman Brothers Holdings, worth about $436,800,000 million. (Numbers from Forbes.Com) He also at one time held a position on the Board of Governors of the New York Stock Exchange.

Fuld owns a $10.8 million Greenwich estate that he calls home. Built in 1936 and purchased by Fuld in 1993 for $7.3 million, the eight-bedroom house has a tennis court, pool and indoor squash court.

Fuld owns a $10.8 million Greenwich estate that he calls home. Built in 1936 and purchased by Fuld in 1993 for $7.3 million, the eight-bedroom house has a tennis court, pool and indoor squash court.

Fuld also owns a home on Florida's Jupiter Island, purchased for nearly $14 million in 2004. He owns a ski house in Vermont. He still owns a summer vacation home in Sun Valley, Idaho. He still owns a full-floor, 16-room, four-bedroom, 5 1/2 bath apartment, which features several fireplaces and six staff rooms, purchased for $21 million in early 2007, that possibly required $10 million in renovations.. Fuld and his wife also owned an art collection with million-dollar paintings.

Fuld and his wife Kathy have three kids, Jacqueline, Chrissie, and Richie. Fuld is listed as a registered Democrat and belongs to the New York-Presbyterian board.

Fuld was once worth close to $1 billion and now has a net worth estimated at about $100 million. He and his wife have been forced to sell some of their renowned art collection.

To learn more about Fuld's rise to power with Lehman when he took over, "The Improbably Power Broker" article from FORTUNE Magazine in 2006 is probably your best bet.

DID YA KNOW?

When Lehman purchased their new building and moved into it in 2002, he ended casual dress. "We were moving into a new building, and we were going to have a ton of clients there, and although I had allowed casual dress, I was dead-set against it," said Fudd. "If you dress sloppy, you think sloppy. Actually, I was even more violently opposed to it than that."

When a reporter told Fuld during an interview, that he could spot members of his company in the Midtown neighborhood they attire -- the women conservatively dressed and the men almost exclusively in white or blue shirts and tied -- Fuld beams. "I love the way they look."

PERSONAL COMMENT

I'd love to see "Dick" be stripped off all his accounts, credit cards, homes, cars, cell-phones and corporate and friend associations for 45 days, starting out with only $100 and the clothes on his back, and be homeless in say, Los Angeles, far from home to see exactly how much of a financial guru he really is. And to let him know what the "real world" is really like.

INFORMATION SOURCES

- Telegraph, UK

- Gothamist

- The Boston Globe

- The New York Times

- LA Times

- Herald Sun

- The Age

- Wall Street Journal

- Financial Times

- Business Week

- Credit Investment News

- Securities Industry and Financial Markets Association (SIFMA)

PICTURE SOURCES

- The New York Times

- Unknown

0 Responses to "Lehman Brothers CEO Fuld Blames Everyone But Himself, Is Being Investigated By Three U.S. Attorney's Offices, And Gets Punched In The Face Over The Weekend By A Former Lehman Bros Employee."

Post a Comment