Is The United States In A Recession? [Look At The Numbers]

RECESSION DEFINITION

[Hey, its like Conjunction-Junction! Sorry… I know it was bad.]

Currently Japan, Germany and all of Europe have announced that they are in a recession as of the end of the 3rd Quarter. Basically here in the United States, we have the “luxury” of not being in a recession until our government tells us we are.

A Recession is “officially” considered two consecutive quarters (six months) of negative growth in the Gross Domestic Product (GDP). This is highly debatable and depends really upon who is talking. It also may take into other factors such as increasing unemployment levels, increasing inflation, house prices declining, the stock market dropping and the value of the dollar dropping.

The Gross Domestic Product is a number that is defined as the total market value of all final goods and services within a country in a given period of time. To make a long story short;

GDP = consumption + gross investment + government spending + (exports – imports)

Consumption is how much one buys.

Gross Investment is the cost of investing.

Government Spending is how much the government is spending.

And exports are how many goods or commodities a country is sending outside the country and imports is how many goods or commodities a country is receiving from outside the country.

A Depression is suppose to be when the GDP drops over 10%, presumed in one quarter. I could be wrong about this, but who wants to use the “Big D” word?

UNITED STATES AND RECESSION

Technically, the United States is in a recession if you go by the two quarters of negative GDP growth, but I haven’t heard any “official” announcement.

GDP:

| Quarter | Rate | Difference from previous quarter. |

| 1st Q (Jan - Mar) | 2.5% | + 0.1% |

| 2nd Q (Apr - Jul) | 2.1% | - 0.4% |

| 3rd Q (Aug - Oct) | 0.8% | - 1.3% |

And one other thought to ponder. If it were not for the government bailing out the banks, and now companies like American Express where would we be? It’s not so much to think about then being bailed out, its more of the point that if they weren’t, they would be gone.

Additionally, the US automakers are now asking the government for money. And in a new report, which I will be blogging about next, even retail outlets are now asking the government for money, such as JCPennys. Additionally, retail outlets are going out of business. Circuit City has closed 155 stores. Linens and Things are gone. Banks have been failing, 19 so far this year alone. States are running out of money. I’ve seen and read about all of these things happening, but not all at one time. What is it going to take before someone says the “R” word for the United States?

A FEW MORE CHARTS FOR YOU TO GANDER AT

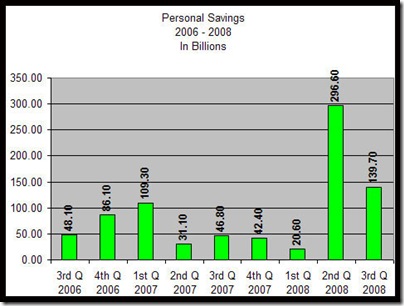

I have to honestly say, I’ve never seen the numbers quite like this.. all at one time. Something happened in June 2008 to cause all this mess. Because if you look at the numbers, by month, major jumps across the board began in June 2008. If you look by quarters, jumps began in 2nd Q, 2008 with both continuing in July, 2008.

All I can remember happening is that gas prices spiked to over $4.00 a gallon, thus causing transportation prices to increase, causing the price of goods to increase. I also remember grocery prices seemed to jump about 30-40% around that time. I don’t recall any “financial” failures at that time. Anyone else have any ideas?

UNEMPLOYMENT

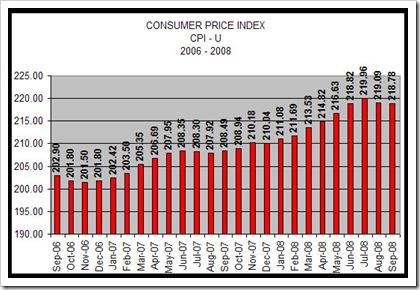

CONSUMER PRICE INDEX

The average price of consumer goods and services purchased by households. To understand the numbers, the Bureau of Labor Statistics based the number 100 on an average of 1982 - 1984 prices. This is called the base. The base CPI is changed every so often with the last time being in 1967. Basically this is so that you don’t notice that there has been a 1000%+ inflation since the start of this measure, which I will show via the inflation graph. The other thing to note is that if the CPI goes up, that means things cost more to purchase and respectively, if it goes down, then something costs less to purchase.

So how to understand the number. Lets say an item cost $1.00 on average between 1982-1984. If today, in 2008 that same item costs $1.85 then the index would be at 185. In the most current data the Sept, 2008 CPI is 218.78. That means a 118.78% inflation from 1982 prices. In other words, what on average cost $1.00 on average between 1982-1984 now costs $2.18

CPI IS NOT the same thing as Inflation.

INFLATION

So now that one understands what the CPI is, lets look at what inflation is. Inflation is simply “an increase in the price you pay for goods.” In other words, a decline in the purchasing power of your money. It is more like a “percent” whereas CPI is a “measure”.

For example, today $1.00 in 1984 has the same buying power as $2.11 in 2008.

If you compare this number $2.11 to the CPI number which is $2.18, you see they are close enough to be nearly the same.

CPI: 218.78 compared to the 1984 base.

Buying Power: $1.00 (1984) = $2.18 (2008) which is a CPI of 218.00 using the 1982-1984 base.

Which means what cost $1.00 in 1984 would cost you $2.18 today.

So when you see the price of something from the Great Depression and say “WOW that is CHEAP!” Its not quite accurate.

Buying Power: $1.00 (1933) = $16.83 which is a CPI of 1683.

This also means what cost $1.00 in 1933 would cost you $16.83 today.

For example, 1 dozen eggs in 1933 cost $0.15. Now at first glace that is REALLY cheap. But when you add in inflation, that same dozen eggs would be equal to $2.40 in 2008. And the price of eggs today,not on sale does cost around $2.00, so in fact, prices were MORE expensive during the Great Depression. I will get more into this comparison at a later date on a separate post.

But the thing to remember from the graph, is inflation is increasing, at a rather fast rate compared to two years ago and one year ago.

PERSONAL SAVINGS

Personal Savings is just what it means. It means how much money we are NOT spending.

CONSUMER SPENDING

aka Personal Consumption Expenditures

This one for some reason, I’m having a hard time finding the exact numbers for however, here’s a graph from the BEA with the August data missing for some reason. This shows that we are not spending the money we are making.

BALANCE OF TRADE

The balance of trade is the difference between the monetary value of exports and imports. A negative balance of trade is known as a trade gap, and means more is being imported than being exported. We as a nation have been importing more goods for a considerable amount of time, versus the amount of goods we export. Thus if consumer spending goes down in the United States, it effects the rest of the world.

So here’s another question? Are we in a recession?

0 Responses to "Is The United States In A Recession? [Look At The Numbers]"

Post a Comment